I expect the same to play out once again. The last four times all these indicators aligned in a similar fashion marked significant short-term lows in the stock price.

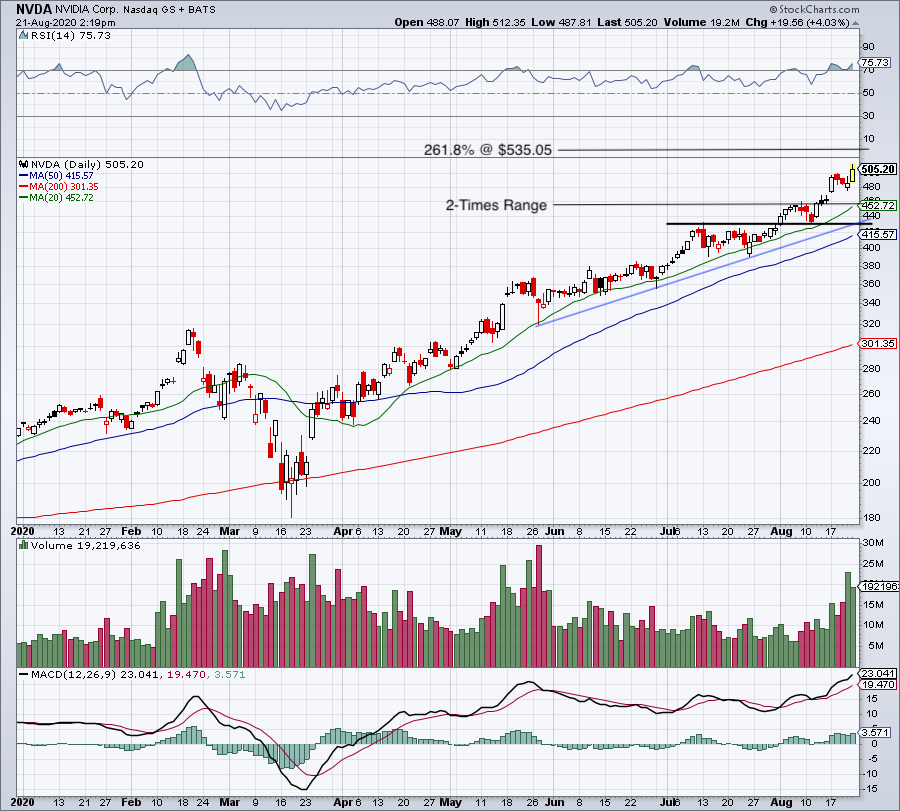

NVDA stock is trading at a large discount to the 20-day moving average. Momentum has fallen back towards the lowest levels of the past year. The nine-day RSI is below 25 and at the most oversold readings of the prior 12 months.

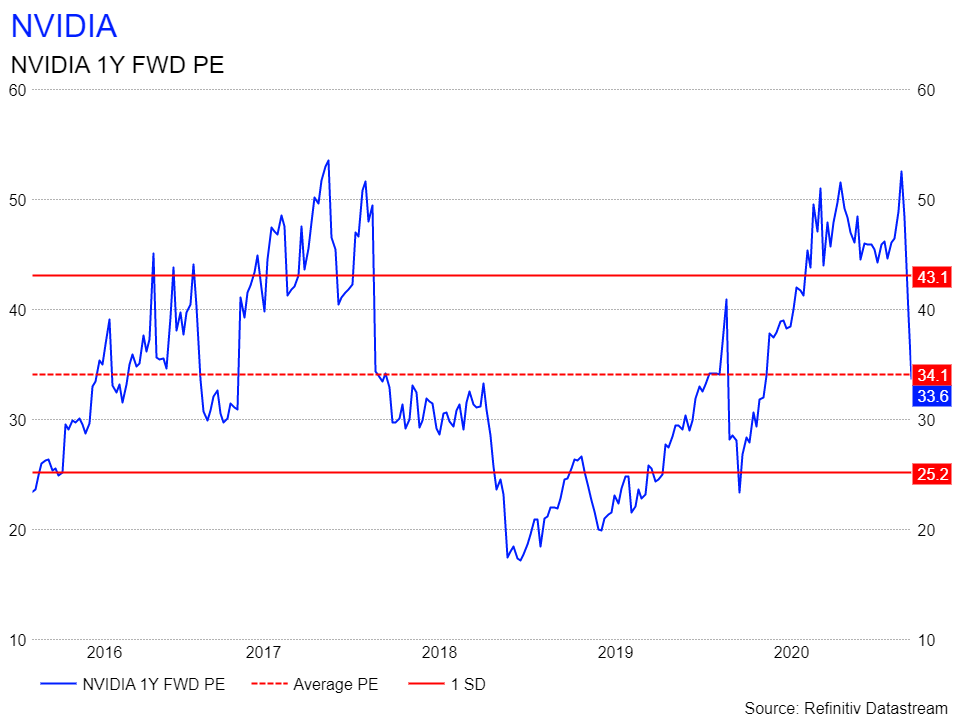

Nvidia is nearing oversold readings that have corresponded with short-term lows in the past. Vandita Jadeja recently noted that Citi analyst Atif Malik has put NVDA on a positive catalysts watch following the Consumer Electronics Show. The lowest individual price target is $285. The analysts tend to agree.Ĭurrently, NVDA is rated a strong buy with a $359.17 consensus price target according to TipRanks. Now that NVDA stock has dropped another $37 points since then to trade near $241, some of the valuation concerns may be starting to soften. He noted the still sky-high multiples that were beginning to scare off investors but remained a long-term bull. InvestorPlace contributor Dana Blakenhorn took a deep dive into NVDA and valuation concerns when the stock was trading at $278 in late December. The recent rise in interest rates has finally brought valuations into question.

0 kommentar(er)

0 kommentar(er)